How Retirement Lifestyle Trends Are Changing

While careers can provide us with a sense of achievement and accomplishment, when the time comes to retire, it’s important that we make it a time filled the people, places and activities that we truly cherish. Planning for your dream retirement often starts well before retirement age. Work somewhat aligned with the information above, research from the ONS has shown that the number of people aged over 70 who are still working in the UK, has doubled to almost 500,000.

The survey found that the number of men aged 70 or over and still in full or part time work has increased by 137%, and the increase for women is 131%.

While some of this has been attributed to the changes in state pension age, the reasons for the older generation working later has also been attributed to the benefits of working past retirement age.

A spokesperson for the DWP commented, “As the researchers highlight, there is a growing understanding of the health and social benefits of working later in life. Everyone who wants to work should be able to regardless of their age, and older workers are making a valuable contribution in workplaces across the UK.”

Many individuals still working in their 60s, 70s and 80s are doing so through choice, citing reasons that their age and experience give them an advantage over younger colleagues, and because they feel an enormous sense of job satisfaction.

We still have a number of residents living at Retirement Village Group locations that work. This case study details Mr and Mrs Biggs, who both still work full-time in demanding positions.

Trend 1:

We’re working longer

In 2021, the state pension age increased to 66 - older than many of our European neighbours - and is set to go up again in the 2040s. Data from Lovemoney shows the average retirement age across the world, with many European countries retiring in their early to mid-60s.

In fact, a 2022 study by Abrdn revealed that 66% of Brits surveyed will choose to continue working in some capacity past the state retirement age. That’s up 10% compared to 2021. Many are opting for part-time work or their own business projects over full retirement. If the trajectory of this trend continues, retirement lifestyles are going to start looking very different over time.

Research from the ONS has shown that the number of people aged over 70 who are still working in the UK, has doubled to almost 500,000. Now, almost one third of all workers are over 50.

While some of this has been attributed to the changes in state pension age, there are positive reasons why older generations are working later.

A spokesperson for the DWP commented, “As the researchers highlight, there is a growing understanding of the health and social benefits of working later in life. Everyone who wants to work should be able to regardless of their age, and older workers are making a valuable contribution in workplaces across the UK.”

Many individuals still working in their 60s, 70s and 80s are doing so through choice, citing reasons that their age and experience give them an advantage over younger colleagues, and because they feel an enormous sense of job satisfaction.

The added flexibility of remote working that followed the shift from office work in 2020 has also impacted how people feel about retirement. When surveyed, remote workers aged 50 to 69 were more likely to be planning a later retirement than those that were office-based.

We have a number of residents living at Retirement Village Group locations that work. This case study details Mr and Mrs Biggs, who both still work full-time in demanding positions.

Trend 2:

Retired volunteers are having an impact

A 2022 study we commissioned showed the real impact that pensioners are having.

As of 2020/21, 8.6 billion pensioners are currently acting as volunteers and one million acting as carers for loved ones. Because of this, retired volunteers are now worth £48bn to the UK economy. This lifestyle trend for retirees has become so significant, it’s responsible for 2% of UK GDP.

It’s pensioners like Judyth Alldays whose contributions are vital to our economy.

Judyth volunteers at a hospice local to Cedars Village where she lives. She works for free as a kitchen assistant and has driven a lorry collecting lottery tickets for patients. Judyth has also volunteered at the local manor house, serving drinks and supporting in the shop.

Will Bax, RVG CEO, comments: “This research highlights the importance of older people to the UK economy. But it’s only half the story, our elders are an army of talent, who are often the glue of society using their time, post retirement, to serve their communities.”

It’s incredibly important retirees are aware of their impactful social contributions so that they can continue to make them for years to come.

Trend 3:

Pensioners are spending more on travel

For many modern retirees, travel plays a central role in their plans for a dream retirement.

Figures from the ONS show individuals over 65 have increased their spending on overseas travel by 37% over the past four years, with £6.2 billion being spent abroad by retirees in 2018.

The annual report from The Association of British Travel in 2018 revealed that individual’s aged over 55 are more likely to take a solo holiday than any other age group, and that one in five people aged over 70 have taken a solo trip.

In fact, Booking.com surveyed over 20,000 global travellers in 2018 and found that 40% of Baby Boomers had travelled alone in the year leading up to the study. Solo travel is often done with group trips and travellers can make life-long friendships on their adventures.

Another travel trend for retirees revealed is that they are more likely to take longer trips than any other age group, staying for an average of 6.6 nights, compared to the average of 5.8 nights of other age groups.

This is a trend that we see regularly across our retirement villages. The ‘lock up and leave’ element of retirement village living means residents that travel frequently or for long periods are confident their property is safe and secure. An extra benefit is that our weekly cleaning and laundry service means they can look forward to returning to a clean home and fresh bedding.

Trend 4:

Retirees are renting more

The number of retirees choosing to rent is ever-increasing. Research from the Centre for Ageing Better reports that the number of people aged 60 and over renting their homes has increased from 254,000 in 2007 to 414,000 in 2018.

Similarly, in 2020 This is Money reported that there has been a 118% increase in the number of 55 to 64 year-olds renting compared to ten years prior, double the growth rate of 35 to 44 year-olds.

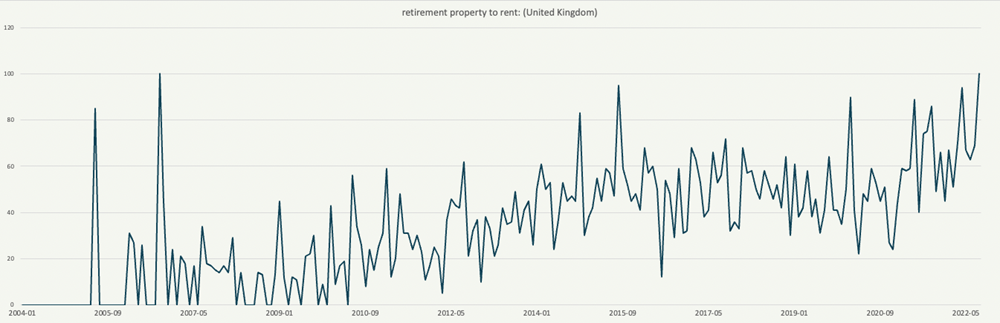

You can see for yourself how the trend in online searches for ‘retirement property to rent’ has increased since 2004:

We undertook our own survey into this trend in 2019, exploring why retirees choose to rent. Of all the reasons listed, 65% said they would rent to remove the worry of property maintenance, while 49% said they would rent for more flexibility. Find out more about the results of the survey on renting in retirement.

Your retirement should be a time for you to relish in the parts of your life that truly bring you joy and contentment. At Retirement Villages Group, we enable you to carve an independent, carefree and fulfilling lifestyle in beautiful surroundings, among like-minded people. Each one of our villages has its own bespoke personality. To learn more about these wonderful locations, you can view our villages, or contact us today. We have a wide selection of retirement properties to rent across all our communities. Why not join us at an open day and find find why many people are choosing this style of living in retirement.